Good demand in Hiab continued

24/04/2018

Questions and answers about January-March 2018 interim report

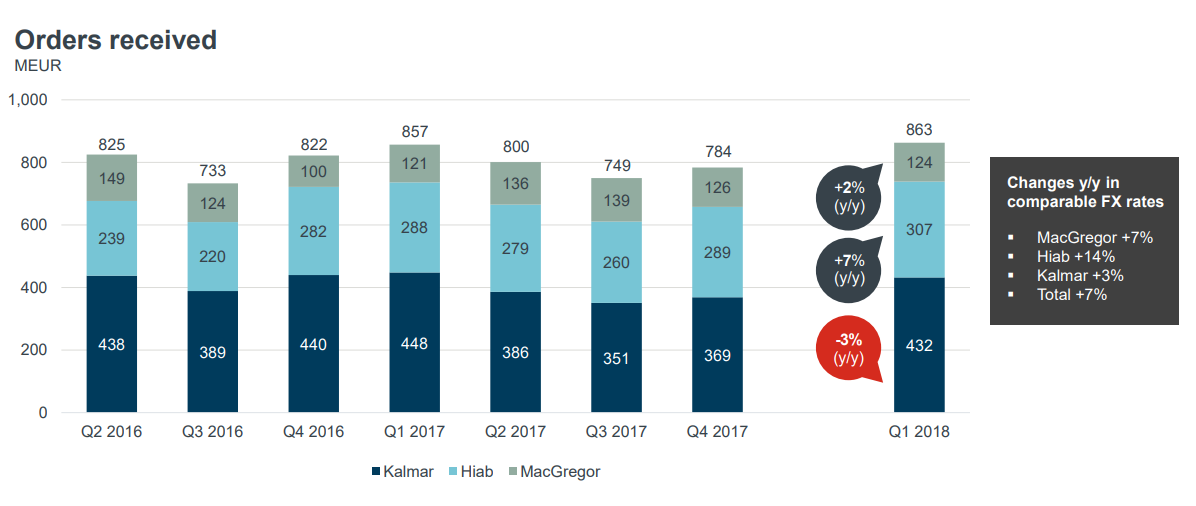

Orders received increased by one percent. In comparable foreign exchange rates, the increase was 7 percent.

What was the impact of the acquired businesses Argos, Rapp Marine and Inver to sales and orders in Q1/18?

The impact was around EUR 10 million in both orders received and sales.

What was the currency exchange rate impact on order intake and sales in Q1?

Compared to Q1/17, currency rate changes had a 6 percentage point negative impact on orders received (+1% reported and +7% in comparable FX rates) and 6 percentage point negative impact on sales (-2% reported and +4% in comparable FX rates). The negative impact is mainly related to the change in EUR/USD exchange rate. The average EUR/USD exchange rate was 15% higher in Q1/18 compared to Q1/17 (1.225 vs 1.065).

Why did software sales decline 10% in Q1?

Quarterly software sales fluctuate depending on TOS order timing. In comparable foreign exchange rates software sales were at comparison period’s level. Our software business developed well during the first quarter from a strategic viewpoint, even though sales remained at last year’s level in comparable foreign exchange rates. The commercialisation of XVELA is proceeding well and six carriers already use the software. A good example of the positive development in the software business was the agreement with Cosco Shipping Ports Ltd. for the Navis N4 terminal operating system.

Why was the cash flow negative in Q1?

Cash flow from operating activities, before financial items and taxes, totalled EUR -3.7 (12.5) million in the first quarter. Cash flow decreased, as more capital was tied up in unfinished inventories due to improved demand in certain product categories in Kalmar and Hiab as well as supply chain issues.

Kalmar Q1 orders received declined 3% y-o-y, why?

In the first quarter, orders received by Kalmar decreased by three percent and totalled EUR 432 (448) million. In comparable foreign exchange rates orders received increased by three percent. Customers consider their project and automation solutions carefully in relation to container throughput volumes, the utilisation rates of existing equipment base and the efficiency of automation technology. Our customers are making smaller deals and focus more on brownfield deals. Customers are also active on smaller mobile equipment and services.

What is the main reason for that Kalmar’s customers are postponing decisions?

Customers consider their project and automation solutions carefully in relation to container throughput volumes, the utilisation rates of existing equipment base and the efficiency of automation technology.

2018 order outlook for MacGregor?

We have seen slow pick-up in the merchant side. However, we are still well below historical levels. Clarkson estimates 1097 (vs 916 in 2017) merchant vessel orders and in offshore 119 (vs 81 in 2017).

How did your service business develop during Q1/18?

Reported service sales grew by 1% and services represented 29% of Cargotec’s total sales. In comparable currencies, service sales grew by 7%: Kalmar +9%, Hiab +10% and MacGregor +0%.

Hiab Q1 order intake increased 7% y-o-y. How do you see market activity going forward?

In Q1 Hiab’s orders increased in EMEA and APAC (16% and 2%), but decreased in AMER (-3%) due to weaker dollar. Going forward construction activity remains key driver, and it is expected to grow globally in 2018.

January-March 2018 interim report in brief

Hanna-Maria Heikkinen, Vice President, Investor Relations, presents Cargotec's Q1 2018 results.