This is how retail investors roasted Cargotec’s IR team - here are their answers

22/06/2020

Cargotec's IR team asked for retail investors to send in questions on social media. We got a great amount of good questions - thank you! Here comes our IR team's response - Q&A to questions received from retail investors. Please note that as certain questions were asked multiple times in slightly different ways, we included each question only once into this blog to keep it more readable.

1. Why is Cargotec more valuable to its owners in its current form compared to Kalmar, Hiab and MacGregor being listed separately?

We actually received multiple questions related to our business area model and related value creation. First of all, Cargotec’s businesses are financially stronger together - for example the acquisition of TTS’s marine and offshore businesses would not have been possible without Cargotec’s financial backbone. There are synergies in strategically important areas like software development and steel procurement, and for example Kalmar and Hiab both have their largest assembly unit in Stargard, Poland. Also, the three businesses have different demand drivers, which diversifies demand-related risk for Cargotec and its shareholders

2. Port automation has been a long-term trend and Navis has a strong market position to benefit from automated container traffic. Considering this, why is Cargotec assessing strategic options for Navis business? Are you not seeing growth opportunities or are you seeing competition in this area?

This was another popular topic. Navis indeed has a very strong market position in terminal operating systems, but on the other hand we have noticed that port automation investments and software choices are rarely made hand-in-hand. Since Navis is already a dominant player in port automation, its growth opportunities are mostly based on expansion to different parts of the logistics value chain, where synergies with Cargotec’s other strategic business units might not be as strong. This is also the reason for assessing strategic options for Navis business.

3. I’ve been keenly following Cargotec’s share price development lately and have been thinking how the future looks from a retail investor’s perspective - does the future look bright or is there a risk of the stock overheating after the COVID-19 situation has eased?

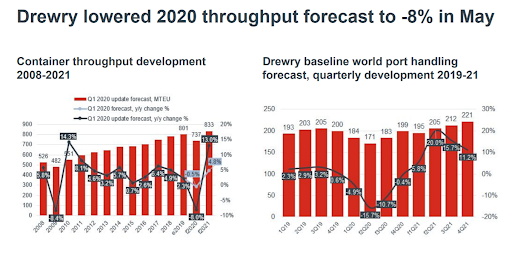

Long term megatrends support Cargotec’s business, and demand indicators - such as global container throughput - have been estimated to continue to grow in the long-term. In 2020, container throughput is estimated to decrease and visibility is currently weak. As a company or company spokespeople we cannot comment or speculate share price value.

4. Have your internal challenges in e.g. production (component shortages, logistical challenges etc.) finally been sorted out? During the past years, they have been mentioned as primary factors hindering profit development. Of course the trade war and COVID-19 situation also play a part. Thank you by the way for your good investor communications!

Thank you for the feedback! The internal challenges described were solved during 2019. The COVID-19 pandemic has affected our production by causing temporary component shortages due to suppliers’ factories being closed during the lockdowns. In addition there have been some challenges in delivering completed equipment to customers.

5. Why has the stock price been decreasing in the longer term?

As a company or company spokespeople we cannot comment or speculate share price value.

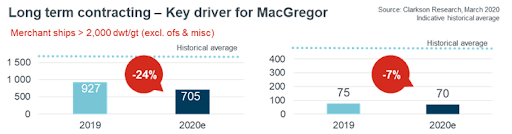

6. When do you estimate that investments will begin to renew the world’s aging ship fleet? In other words, when will MacGregor return to significant profitability?

Ship investments in both merchant and offshore are currently at a historically low level. It is hard to estimate when investments will start picking up. Instead, we have focused on actions to turn MacGregor profitable again in the current environment. Clarkson Research estimates that ship investments will slightly increase after 2020.

7. Only about 40 of the world’s 1,200 ports have are fully automated. When will we see automation accelerating?

Automated ports have proved to be efficient and we have noticed that customers have moved from whether they should consider automation at all to when and how they will do it. The COVID-19 crisis has put many big investment decisions on hold, e.g. significant automation investments have not been made during the pandemic. On the other hand, the situation has only highlighted the long-term need for automation.

8. How will Cargotec adapt to inland ports, if production is insourced and cargo hubs could well be inshore?

We already have customers also in inland ports, e.g. intermodal customers, inland waterwats and rail transport. For Kalmar Mobile Equipment these are segments with growth potential. As one recent example, the EU-funded AEGIS (Advanced, Efficient and Green Intermodal Systems) project featuring both Kalmar and MacGregor is developing connected waterborne transport in Europe.

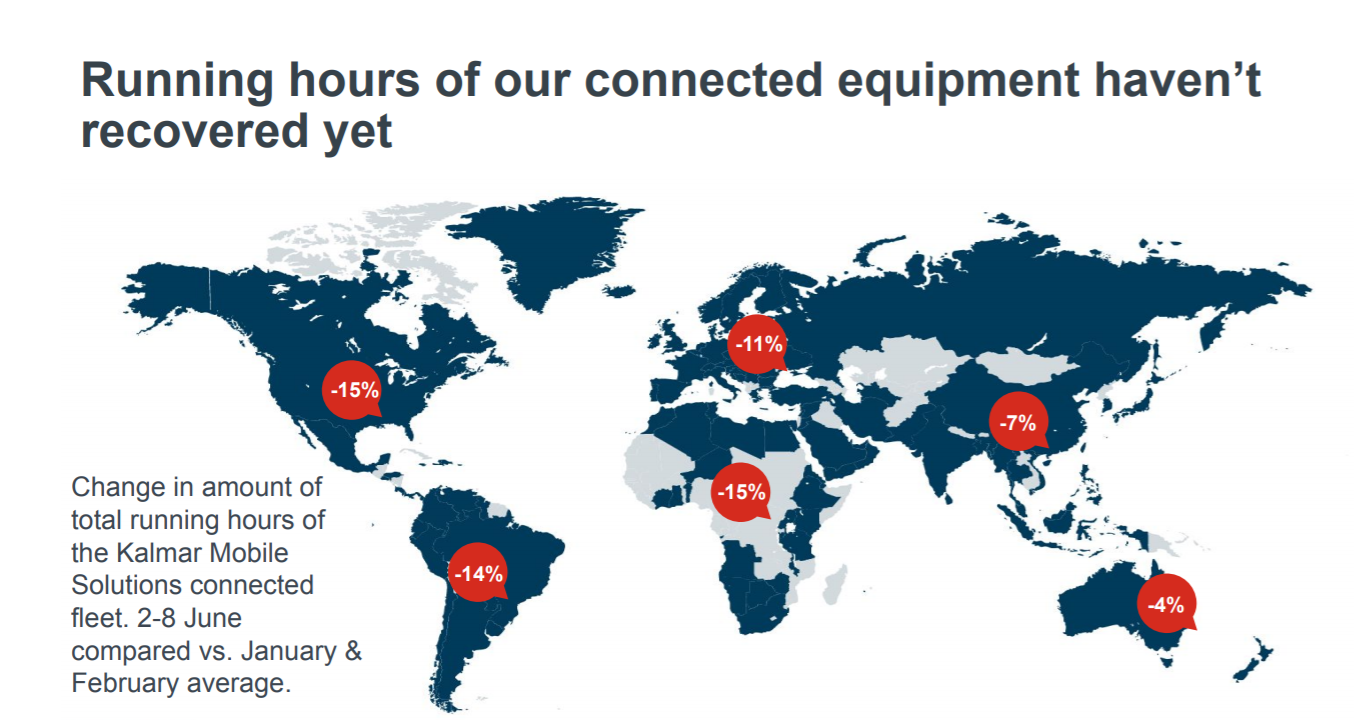

9. Can you show a visualisation snapshot of global traffic flows stopping and restarting in Q1-Q2 2020 based on your software.

As shown in our CEO’s presentation for sell-side analysts in June, we saw that, based on Kalmar’s connected equipment data, volumes dropped in North America by 15 percent and 11 percent in Europe when comparing the first week of June to the January-February average. Volumes are recovering, but are not at a pre-COVID-19 level yet.

10. How does the cargo demand look like, is there room for more capacity? In addition, is there any numeric forecast for the rest of the year, or is visibility still weak?

According to Drewry’s forecast, global container throughput will decrease by 8 percent this year and is expected to recover in 2021 by 13 percent, although there is uncertainty involved.

11. Did you notice an increase in direct meeting requests from investors and if yes, how you are handling this? Do you use any tools to manage those request and target directly investors?

Meeting requests have not increased recently, actually quite the contrary. We do use a CRM tool for IR to manage requests.